Unexpected Costs for First-Time Homebuyers

Some first-time buyers are surprised by the full cost of homeownership.To prepare your budget, consider these extra costs:Closing costs typically total 2 – 5 percent of the purchase price and are in addition to down payments.Homeowners insurance costs an average of around $1,000 a year, but prices vary. If in a flood or earthquake zone, youll need extra hazard insurance.Property taxes could range from hundreds of dollars to thousands a year, and they often fluctuate.All home maintenance becomes your responsibility, so save money for normal upkeep and emergency repairs.Youll also need to pay for all utilities. If moving from a smaller apartment, expect the larger home to have higher bills.Nevertheless, the pride of homeownership is priceless.Published with permission from RISMedia.

Categories

Recent Posts

Why Having a Will Matters More Than You Think

Latest Trends in the North American Housing Market

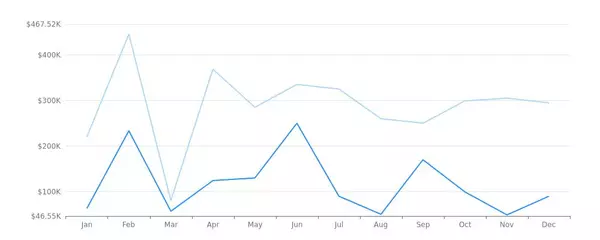

Real Estate Market Report - Odessa, TX (Jan, 2024)

Sell Your Home to a Cash Buyer and Close Quickly

How to Design With Art Deco

What Is a Negotiated Debt Settlement?

What Identity Thieves Want from Your Facebook Profile

3 Tips for Displaying Your Art Collection at Home

Understanding Credit Card Offers: Are You Reading the Fine Print?

Smart Home Gadgets That Will Elevate Your Home

GET MORE INFORMATION