5 Financial Tips for First-Time Parents

So a babe is on the way? Congrats! Along with the chaos of, well, everything that is to come, your finances are about to experience an upheaval, as well. According to the U.S. Department of Agriculture, it will cost upwards of $245,000 to raise a child born in 2013 to the age of 18"and this does not

5 Beautiful Gardens for Your Home

Published with permission from RISMedia.

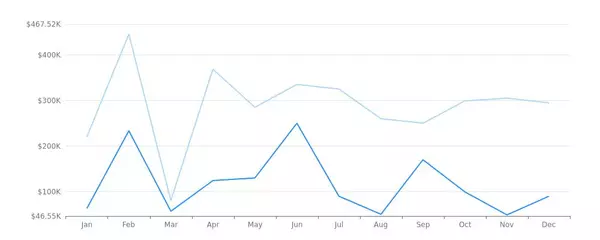

A Breakdown of How Student Loans Work

Federal student loans are often the first step for students looking for help paying for college.While theyre not the only type of loan available for college students, theyre the most common. It’s also important to note that they’re different than private student loans. Here are some of the main diff

Categories

Recent Posts