Debit Cards: Why You Should Proceed With Caution

A debit card can be your worst enemy when it comes to identity fraud.Credit and debit card fraud totaled $4.5 billion in 2016, according to a report by iovation, a provider of digital intelligence for fraud prevention.A debit card can be a smart way to shop if you dont want to carry cash or use a credit card and pay interest on unpaid balances. But they come with a few drawbacks.First, a debit card is linked directly to your bank account, so anyone with your card information can instantly withdraw all of the money from your account. Second, debit cards dont have near the amount of protections that credit cards do for consumers.If your credit card is lost or stolen, or the information on it is stolen, you cant lose more than $50 in unauthorized transactions if you report it to your credit card issuer. A debit card carries the same protections, but if reported more than two days later, you can be liable for all of the money withdrawn illegally.Avoiding Debit Card TheftIn addition to data hacks such as at Uber that should worry consumers about their personal information being used by fraudsters, criminals can hide skimmer devices inside gas station pumps to steal credit and debit card information.When using a debit card, only withdraw money from bank-affiliated ATMs. They have a higher level of security than independent ATMs at gas stations or other businesses. Be sure to cover the keypad when entering your information.Shred your bank and credit card statements so that thieves cant pull your data from your trash can, and check your accounts and statements daily to make sure all of the transactions are legitimate.If you can limit yourself to only spending as much as you can afford, then only use a credit card and put your debit card away. Only use your debit card for cash withdrawals, since a debit card offers much less financial protections than a credit card if stolen.Dont open emails that come from someone or a site you dont know. Phishing emails often use a phony website to lure victims to give up their card or bank account numbers, so never give out this information to anyone who asks for it, unless the email is coming from a trusted source.Sign up for fraud alerts from your bank and credit card company. If you think youve been the victim of identity theft, institute a credit freeze to prevent anyone from opening a new account in your name.Published with permission from RISMedia.

Categories

Recent Posts

Why Having a Will Matters More Than You Think

Latest Trends in the North American Housing Market

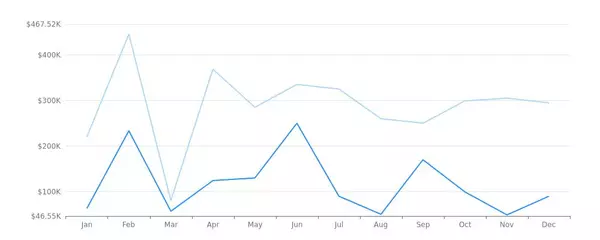

Real Estate Market Report - Odessa, TX (Jan, 2024)

Sell Your Home to a Cash Buyer and Close Quickly

How to Design With Art Deco

What Is a Negotiated Debt Settlement?

What Identity Thieves Want from Your Facebook Profile

3 Tips for Displaying Your Art Collection at Home

Understanding Credit Card Offers: Are You Reading the Fine Print?

Smart Home Gadgets That Will Elevate Your Home

GET MORE INFORMATION