Why Having a Will Matters More Than You Think

Let me share two real-world heirship situations I’ve recently dealt with that show how quickly things can get messy when someone passes without a will:

Scenario 1:

We had a file clear to close. Everyone was ready to sign, buyers were patient, money lined up—then on the day of closing, one heir decided she wanted to renegotiate with her sibling. What was her demand?

Mom’s old car.

She refused to sign unless she got it. Thousands of dollars at stake and a possible foreclosure & this deal has almost collapsed… all over a car.

Scenario 2:

A seller inherited a property and later added his wife to the deed. She passed away, which meant her half transferred to her children. Simple, right? Not so fast. She had three other children outside the marriage—two deceased, one with no kids, another allegedly with three kids of his own. We could only verify two of this heirs children. The “third child” had no record anywhere; turns out, the family just assumed she belonged because of a childhood picture. The 3rd son who is alive, will not sign over his inheritance to the original owner and demands that he get paid (which in this case is his right)

The Common Thread?

Neither of the deceased had a will.

Because of that, the heirs are stuck in drawn-out investigations, attorney fees, title delays, and the constant risk of losing a sale—or worse, the property itself.

The Takeaway:

If you want to make life easier for your family when you pass, have a will.

It doesn’t just protect your property—it protects your loved ones from conflict, saves them thousands in legal costs, and ensures your wishes are honored without guesswork or speculation.

Don’t leave your family to fight over cars, or chase down heirs who may not even exist. A simple will today can save years of frustration tomorrow.

Scenario 1:

We had a file clear to close. Everyone was ready to sign, buyers were patient, money lined up—then on the day of closing, one heir decided she wanted to renegotiate with her sibling. What was her demand?

Mom’s old car.

She refused to sign unless she got it. Thousands of dollars at stake and a possible foreclosure & this deal has almost collapsed… all over a car.

Scenario 2:

A seller inherited a property and later added his wife to the deed. She passed away, which meant her half transferred to her children. Simple, right? Not so fast. She had three other children outside the marriage—two deceased, one with no kids, another allegedly with three kids of his own. We could only verify two of this heirs children. The “third child” had no record anywhere; turns out, the family just assumed she belonged because of a childhood picture. The 3rd son who is alive, will not sign over his inheritance to the original owner and demands that he get paid (which in this case is his right)

The Common Thread?

Neither of the deceased had a will.

Because of that, the heirs are stuck in drawn-out investigations, attorney fees, title delays, and the constant risk of losing a sale—or worse, the property itself.

The Takeaway:

If you want to make life easier for your family when you pass, have a will.

It doesn’t just protect your property—it protects your loved ones from conflict, saves them thousands in legal costs, and ensures your wishes are honored without guesswork or speculation.

Don’t leave your family to fight over cars, or chase down heirs who may not even exist. A simple will today can save years of frustration tomorrow.

Categories

Recent Posts

Why Having a Will Matters More Than You Think

Latest Trends in the North American Housing Market

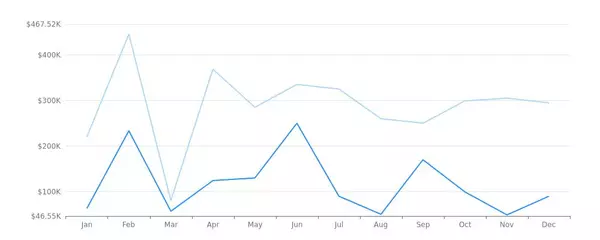

Real Estate Market Report - Odessa, TX (Jan, 2024)

Sell Your Home to a Cash Buyer and Close Quickly

How to Design With Art Deco

What Is a Negotiated Debt Settlement?

What Identity Thieves Want from Your Facebook Profile

3 Tips for Displaying Your Art Collection at Home

Understanding Credit Card Offers: Are You Reading the Fine Print?

Smart Home Gadgets That Will Elevate Your Home

GET MORE INFORMATION