What Are Your Rights in Debt Collection?

If debt collectors are calling or sending you letters demanding payment, you may be worried"and for good reason.Not only can having a debt in collections stay on your credit report for up to seven years, but it can seem like youre being barraged by debt collection notices from a different company than the original creditor you owed. It can be confusing.If youre more than 30 days late on a debt payment, it may be reported as delinquent. Hit 180 days, and the credit card company, bank or other creditor may stop trying to collect and sell your debt to a third-party debt collector.Even if theyre only seeking pennies on the dollar to settle your debt, you still have rights under the Fair Debt Collection Practices Act. Here are some to be aware of:You Can Limit CommunicationsConsumers can tell a debt collector to stop contacting them, and they cant contact you at work if you ask them not to. Make the request in writing. The debt still exists, but the collector will have to stop contacting you and can seek payment through a lawsuit. The law also prevents debt collectors from contacting you before 8 a.m. or after 9 p.m., and from talking to your neighbors, employer or family about your debt.They Can’t Harass YouDebt collectors also cant harass or use abusive practices to try to collect. This is more than just repeated phone calls. They cant mislead, coerce or make you fear for retribution. They cant swear at you, threaten violence, call repeatedly, not identify themselves as debt collectors or list your debt for sale to the public. Keep a log of any abuses and file a with the Consumer Financial Protection Bureau.They Cant Lie to YouDebt collectors also cant lie. This includes using false, deceptive or misleading statements to collect the debt. For example, they cant misrepresent the amount of the debt or what the legal repercussions are for not paying. Also, they can’t pass themselves off as another company or authority figure, such as a police officer.They also cant say your debt is past the statute of limitations"the legal limit to how many years creditors have to sue for payment. Once that time limit has passes, you can no longer be sued for the debt. The statute of limitations varies by state and type of debt. For credit card debt, its three years in most states, though some states allow up to 10 years. The debt is still on the books, meaning that future creditors will see it and youll likely have a harder time getting credit at good rates.These are some of the rights consumers have in debt collection. If you think youre being asked to pay a debt that isnt yours, or are hassled about a debt, contact a lawyer or the CFPB for help.Published with permission from RISMedia.

Categories

Recent Posts

Why Having a Will Matters More Than You Think

Latest Trends in the North American Housing Market

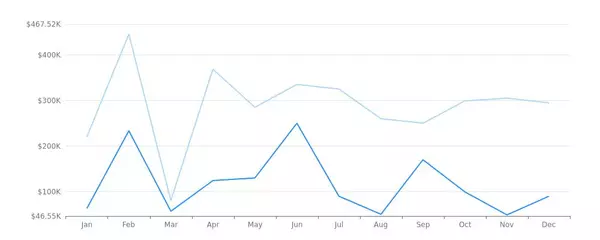

Real Estate Market Report - Odessa, TX (Jan, 2024)

Sell Your Home to a Cash Buyer and Close Quickly

How to Design With Art Deco

What Is a Negotiated Debt Settlement?

What Identity Thieves Want from Your Facebook Profile

3 Tips for Displaying Your Art Collection at Home

Understanding Credit Card Offers: Are You Reading the Fine Print?

Smart Home Gadgets That Will Elevate Your Home

GET MORE INFORMATION