Smart Home Gadgets That Will Elevate Your Home

Technology seems to mutate with the speed of light, but is your home keeping up with the changes? Smarten it up with a few smart-home electronics that will boost safety, increase comfort and may even save you a few bucks:Video Doorbell The VTech Video Doorbell, about $115, lets you screen and even v

5 Ideas for Remodeling Your Basement

Looking to update your basement? Here are a few ideas…Home TheaterBasements are the perfect place to design the home theater of your dreams.Fitness AreaA fitness area in your basement is rather simple, with the most important features being mirrored walls and a durable floor.Relaxing SpaA place to u

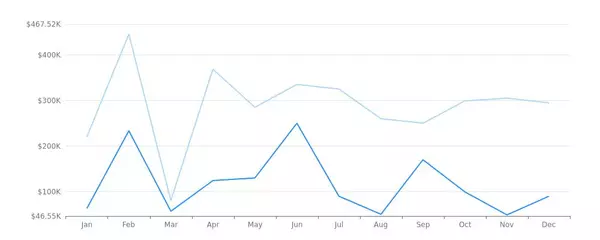

The Good and Bad of Zero-Interest Credit Cards

The offer of a zero-interest credit card can look enticing when it arrives in the mail. Who doesnt want to avoid paying interest on credit card charges?As with most things in life, there are pros and cons to using 0-percent credit cards. Here are some facts to consider before you respond to that off

Categories

Recent Posts