Steps to Take After Identity Theft

Reacting quickly is essential after youve been the victim of identity theft. It can lessen the damage by thieves and lower the stress of having your credit card lost or stolen.You may notice when you get home that your credit card is missing. Or you may get an email from your credit card company tha

Making the Most of Your Credit Card Rewards

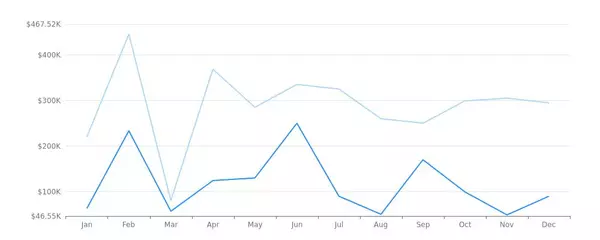

Using a credit card to earn rewards is pretty simple. Just use the card to buy things and youll get cash back or reward points from your credit card company.Getting that free money of 5 percent or even more on every purchase is easy, but there are some things you should pay attention to if you want

5 State-of-the-Art Features for a Secure Home

These cutting-edge security features will ensure your property is prepared for anything!Biometric KeypadWith biometric keypads, all of your doors can be set to automatically lock and simply require your fingerprint to open.Home FirewallInstalling a firewall provides an extra layer of protection to a

Categories

Recent Posts